Here are some of the reasons investors have ramped up buying and selling precious metals

Whatever I write explaining it becomes obsolete as soon as these letters appear on my screen. But the reality is that the prices of gold and silver, in particular among precious metals, generally are rising and evidence points to these increases probably continuing.

The price of gold continues to flirt with $2,000 an ounce as I type this on Oct. 17, 2020. This is a level only reached twice before, in 1980 and in 2011. It has risen 27 percent so far this year after rising 19 percent in 2019. Silver on Oct. 17 is going for slightly more than $24 an ounce. It has risen 36.6 percent so far in 2020 and went up 15.4 percent in 2019.

Perhaps chief among the reasons for these higher values is uncertainty — both the economic and the political varieties.

Economic reasons

Gold and silver are viewed as being among the safer havens for wealth when investors and economists worry that the world might not be able to do business in a functional and stable financial system. And, like anything, purchases of commodities increase their prices.

Economies globally have continued to be undermined by Covid-19 surges and lockdowns that constrain production, sales and livelihoods.

The central banks of the U.S. and Europe have worked to counter that damage in ways that are seen as making inflation more likely. Such rises in prices repeatedly have defied expectations by failing to show up. But a perception among investors that they might finally make an appearance tends to inspire them to purchase gold and silver, which are seen as hedges against inflation.

One trend, however, is working against gold and silver prices and the metals’ attractiveness to investors: How much it takes in euros and other non-U.S. currencies to buy U.S. dollars. That’s because gold and silver (like oil) are priced in dollars. And if the dollar rises in price, it costs more for non-U.S. investors to buy these commodities. The dollar also is seen as a safe-haven investment in times of uncertainty. The price of the dollar generally has risen in 2020 after a long slide from the winter of 2018, when the exchange rate was 1 euro to $1.18. It was $1.09 in March 2020, just before the significance of the Corona Virus emerged. On Oct. 17, 2020, the exchange rate was 1 euro to $1.17.

To sum up the level of economic uncertainty in late 2020, the pandemic is still causing huge concern.

International trade and politics

Global trade and supply chains continue to suffer friction where politics and economies meet. One of those intersections is the ongoing trade war between the two biggest economies, the U.S. and China. Also at the nexus of the economy and politics is the inability of U.S. lawmakers to agree on a second stimulus package.

Political uncertainty is rising as remarks by President Trump are being interpreted as warnings that any transition of federal administrations would be delayed and contentious. The prospect of a possible victory by the Democratic Party candidate also is inspiring concern among some observers and business leaders who believe Biden-Harris policies would be less favorable toward business.

The coming presidential vote and the widening crevasse between the right and left in U.S. politics have led a growing number of people to conclude that purchasing precious metals such as silver and gold is a sensible preparation for a possible crisis.

The coming presidential vote and the widening crevasse between the right and left in U.S. politics have led a growing number of people to conclude that purchasing precious metals such as silver and gold is a sensible preparation for a possible crisis.

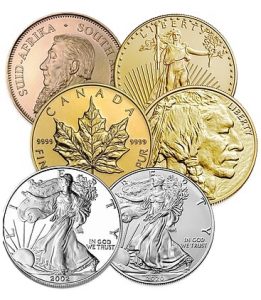

For these people, having some of their wealth in gold and silver, perhaps especially in widely recognized coins minted by governments in guaranteed purity and weight, will be useful if people lose faith in so-called fiat currencies that are not backed by physical assets. They also worry that having all of their money represented by numbers on a screen might prove obsolete, like the words I’m typing.

Cryptocurrencies are viewed as just too intangible and difficult to fully understand for a large portion of the older demographic that has the most disposable money to invest.

At the same time, some investors are looking at the precious metals they already own and selectively taking profits or reallocating to a mixture of gold, silver, and platinum that they believe will create a more diversified and less volatile metals portfolio.

When buying precious metals, it is important to work with an Accredited Precious Metals Dealer such as Pegasus Coin and Jewelry. These dealers are vetted, required to uphold professional standards, and are subject to binding arbitration to hold them accountable.